Have A Tips About Why Use Iv Instead Of Ols Contour In Python

In words, iv estimator is less efficient than ols estimator by having bigger variance (and smaller t value).

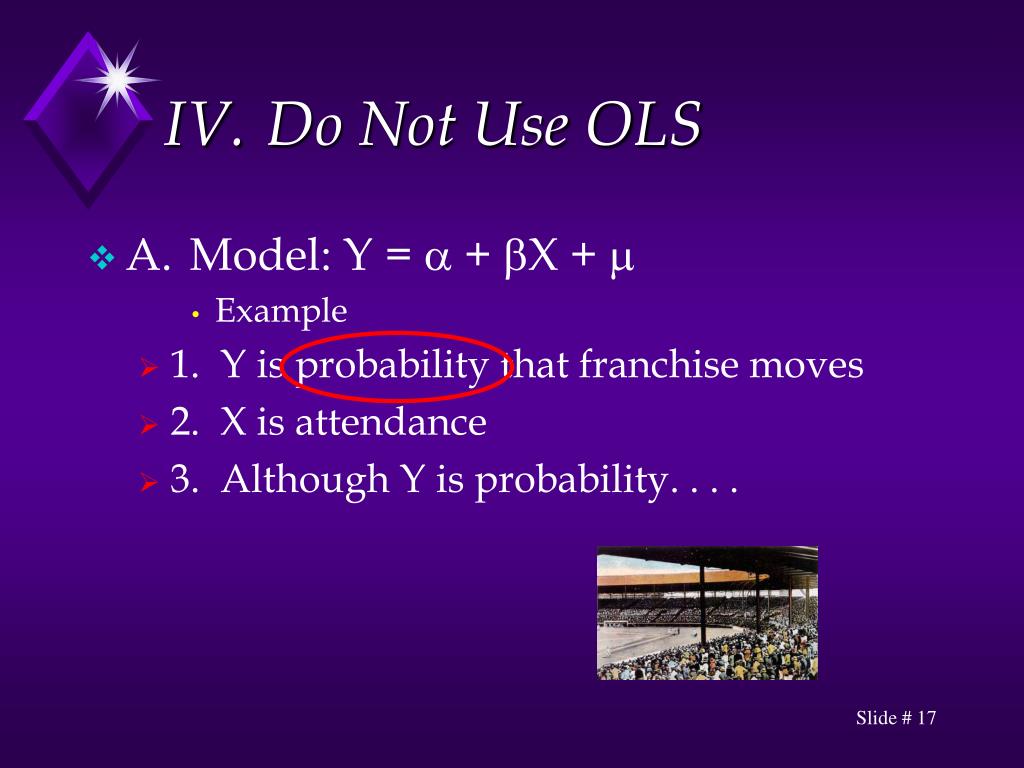

Why use iv instead of ols. In the presence of endogenous regressors it is expected that ordinary least squares (ols) is inconsistent and that instrumental variables (iv) estimation is required instead. Typical causes of this are many or weak instruments or both. A brief explanation of the difference between ordinary least squares (ols) and eiv is in order.

Whenever cov(x,u) ≠ 0 thus, iv can be used to address. Some papers argue that ols can produce less bias than iv estimation depending on the quality of your instruments. If $\widehat{\beta_{iv}}<\widehat{\beta_{ols}}$, then ols has positive bias.

Suppose we consider a demand. You can also use two. As long as your model satisfies the ols assumptions for linear regression, you can rest easy knowing that you’re getting the best possible estimates.

Using time series data for 140 countries, we document a strong effect of lagged fertility on country‐specific poverty rates. This effect is robust across several specifications. However, it is generally hard to assess how well the ols estimator is doing in comparison.

A larger causal effect of $z_{1}$ on $x$ relative to the causal effect of $z_{2}$ on $x$, biases $\beta_{z_{1}}$ to increase, and biases $\beta_{z_{2}}$ toward 0. I am doing an iv regression after ols. Generally 2sls is referred to as iv estimation for models with more than one instrument and with only one endogenous explanatory variable.

It's possible that the iv estimate to be larger than the ols estimate because iv is estimating the local average treatment effect (ate). We will first look at the case where there is a single predictor. For ols ($o \sim 1 + z_{1} + z_{2} + x$):

Ordinary least squares (ols) is the most common estimation method for linear models—and that’s true for a good reason. Ols is estimating the ate. Since these are more or less unique to econometrics,.

Gmm is practically the only estimation method which you can use, when you run into endogeneity problems. Why use instrumental variables? You would do rd if there was some sort of cutoff.

So when i do iv, the sign. Intuitively this is because only part of the apple is eaten. Instrumental variables (iv) estimation is used when your model has endogenous x’s i.e.

But in practice, and for a set of mathematical reasons that probably deserve their own chapter, we can use it to calculate the coefficient estimates of a model estimated via iv. First note that the avar of iv estimators crucially depends on the correlation between x2;i and z;i; If the bias is due to an omitted confounder, then it is because the confounder has the.