Awe-Inspiring Examples Of Tips About How Can A Trendline Be Applied Google Sheets Xy Chart

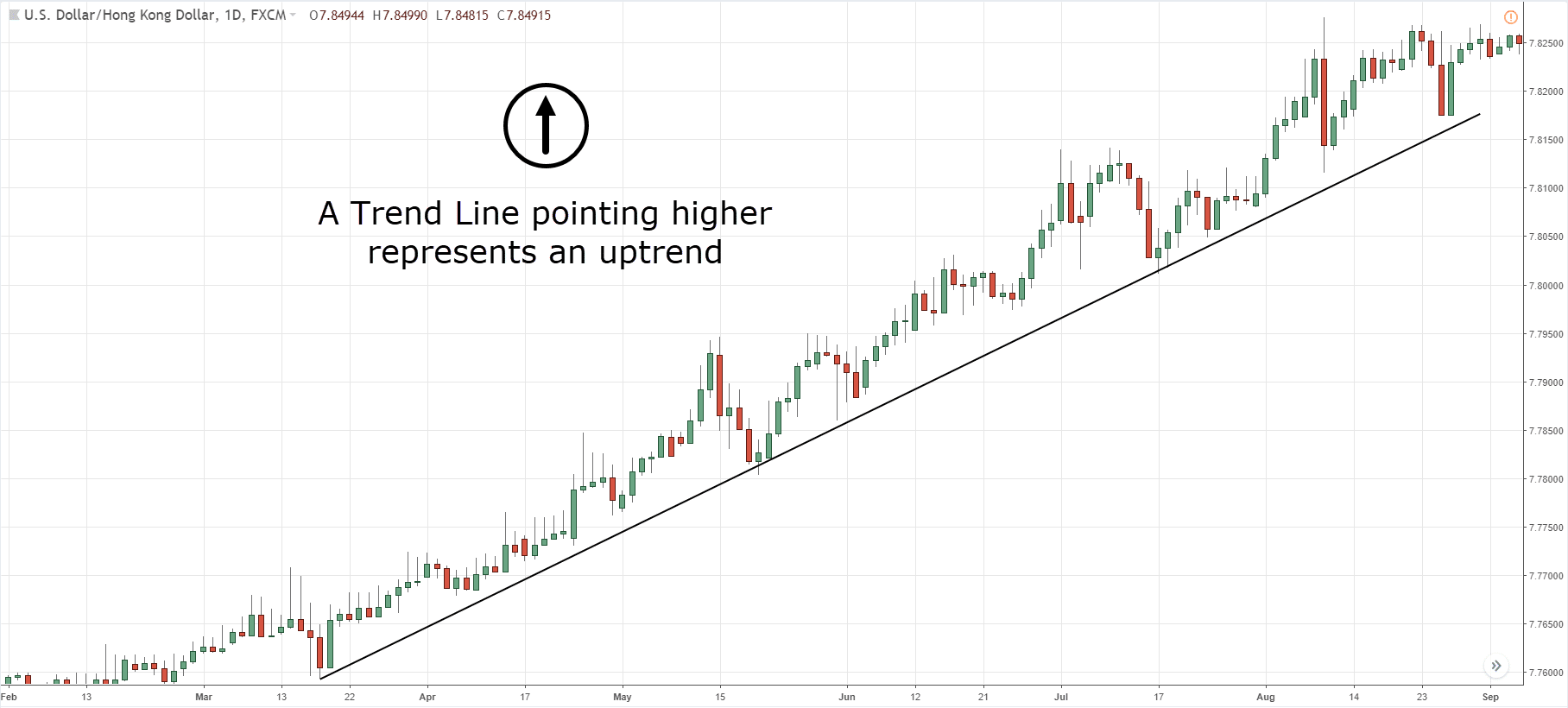

Trend lines are used to visualize the overall trend and provide a framework for understanding price action.

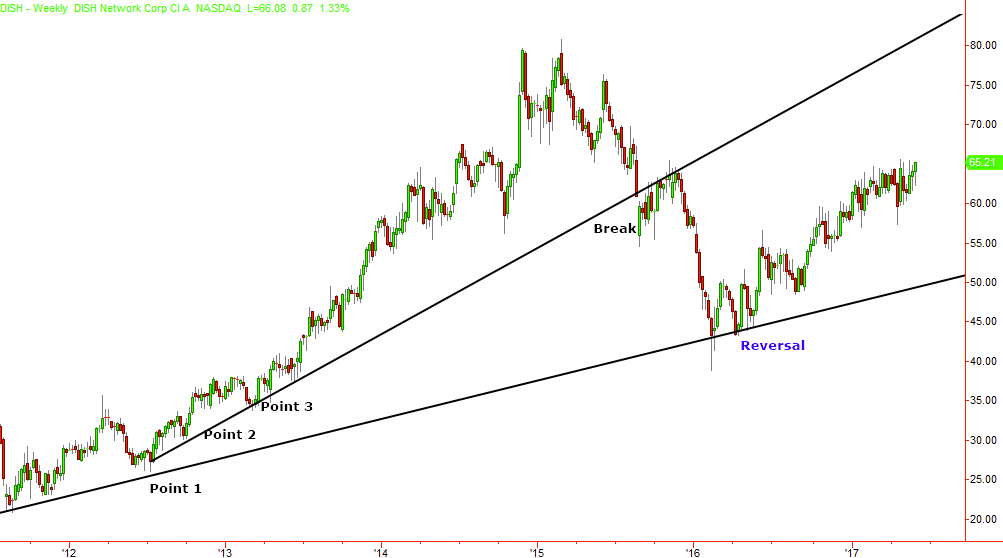

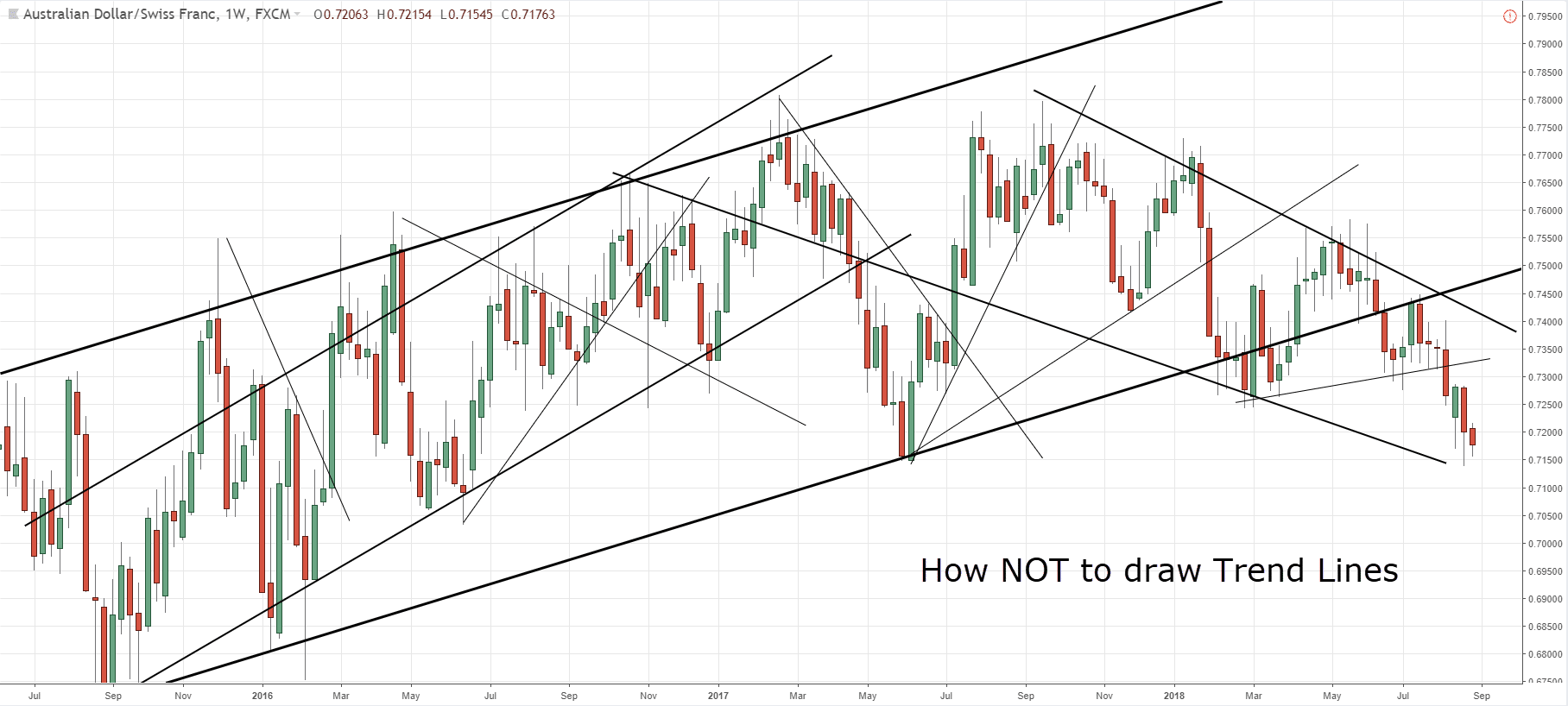

How can a trendline be applied. A trend line is a straight line drawn on a price chart that connects two or more significant price points. As straight lines, they geometrically pass through two points which, in economic trend charts, correspond to prices. Don’t disregard this instrument in favor of more complicated tools, as trendlines can be very helpful for your trading.

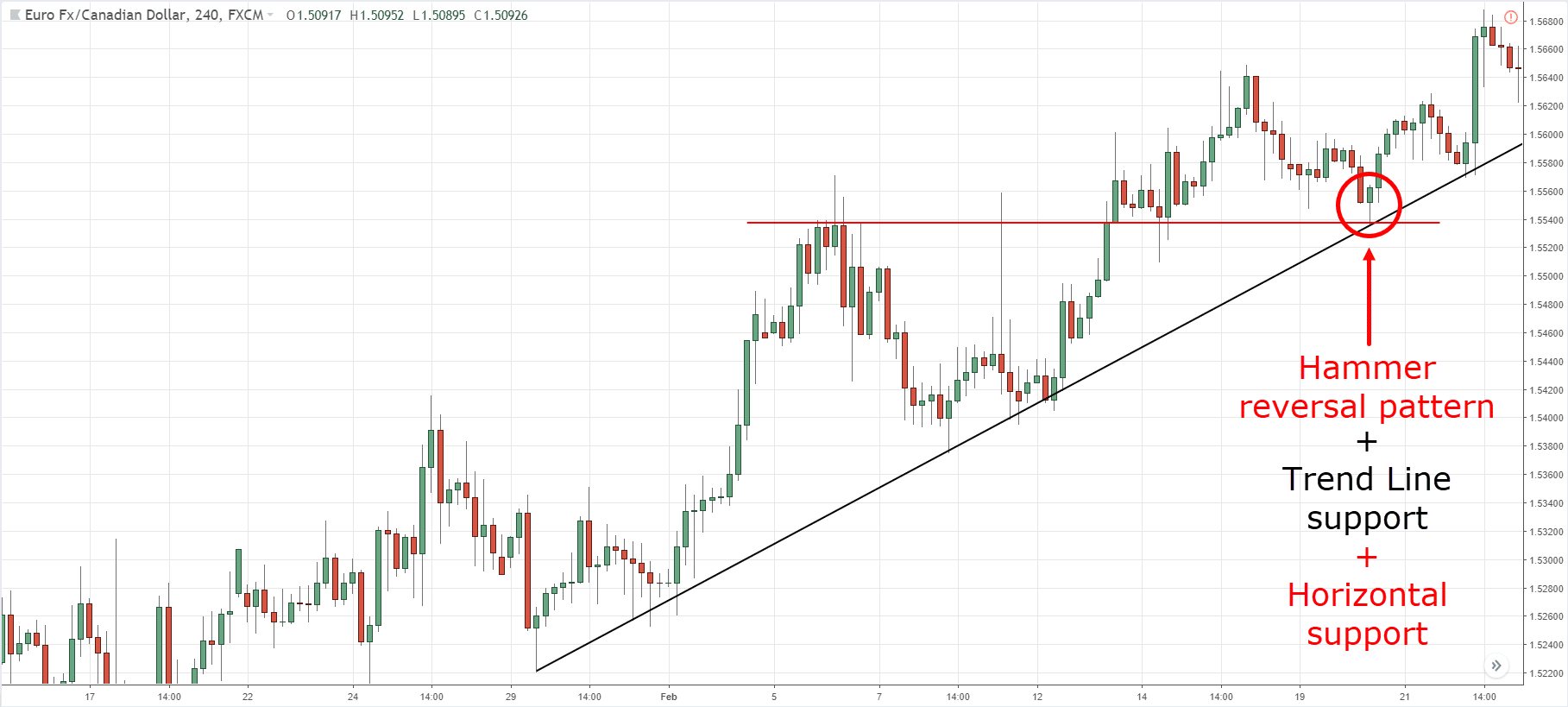

A trendline can be a valuable technical analysis tool for developing trading strategies. Trendlines visually represent support and resistance in any timeframe by showing direction, pattern and price contraction. It represents the direction and slope of the market trend, whether it is moving up, down, or sideways.

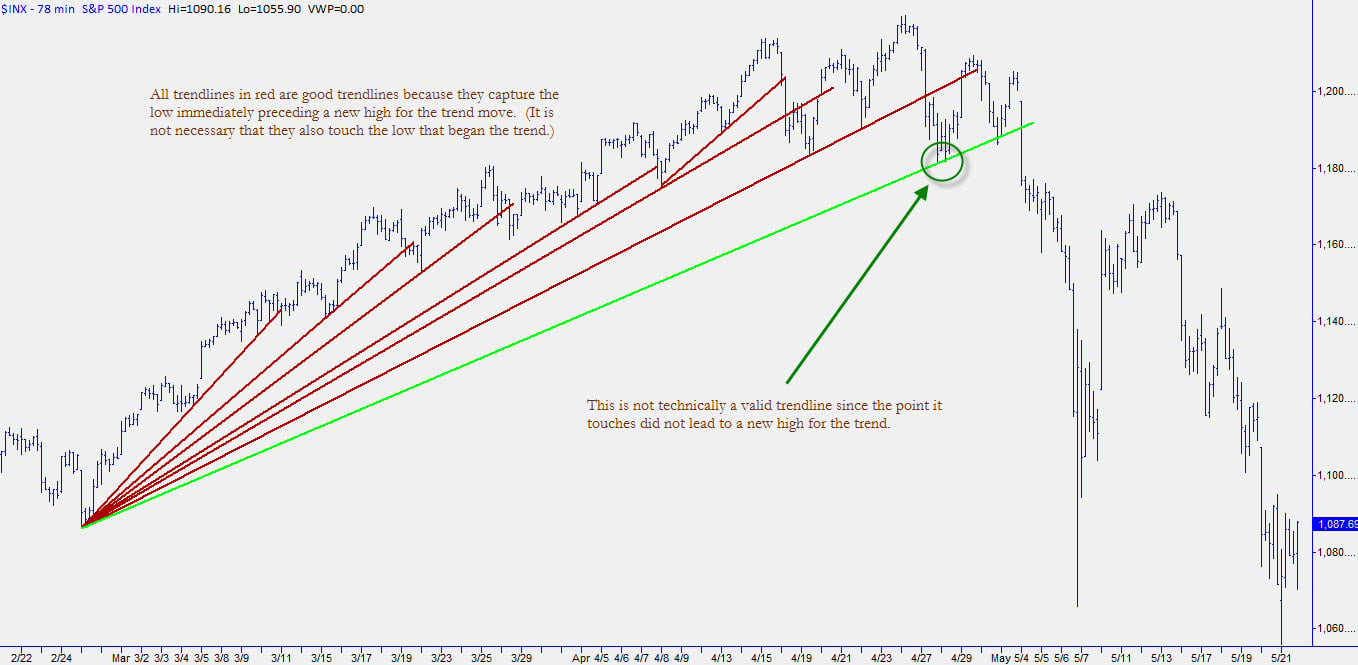

The time period being analyzed and the exact points used to create a trendline vary from trader to trader. The line itself can take on many forms depending on the shape of the data: Trend lines are one of the most universal tools for trading in any market, used in intraday, swing and position trading strategies.

Your capital is at risk. The main benefit of drawing trendlines is that they make the picture on the chart clearer. Pay attention to price action, and always consider it when using trendlines.

Identify a plausible trend by observation of plotted bivariate data. Drawing trend lines for trading. Define the coefficient of determination and use it to quantify the correlation of data assuming a particular trend.

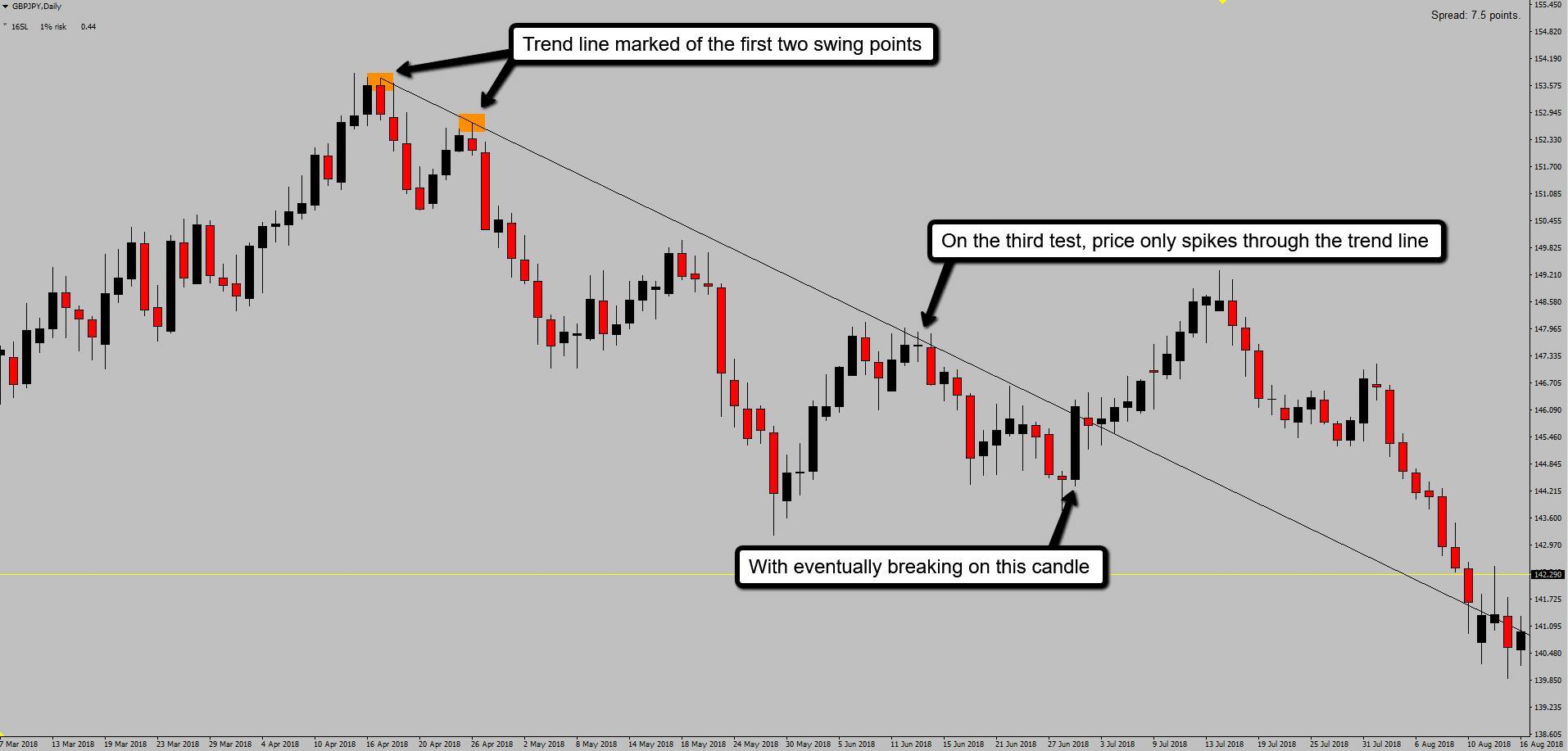

If the price makes lower lows and lower highs, it's still a downtrend—even if the price moves above a descending trendline. Trendlines are drawn on a price chart, usually using candlestick or bar charts. Channels also highlight likely important support and resistance levels for the chart involved.

Trend lines are straight lines that connect two or more price points on a chart to identify and confirm trends. In this article you will learn more specifically what trendlines are, how to draw a bearish (or bullish) trendline and, through practical examples, how to use trendlines in trading. Trend lines are diagonal or horizontal lines drawn across specific swing points on a trend that represents support or resistance levels and help predict where the next touchpoint could be.

Types of trendlines, including linear, logarithmic, polynomial, power, exponential, and moving average, offer flexibility in analyzing price data and identifying trends. A trend line is a slanting straight line connecting two or more price points (importantly higher lows or lower highs) and extending into the future to act as a support or resistance line. Define and explain trendlines (aka curve fitting, least squares fit, lines of best fit, and regression).

Creating a trendline requires a minimum of two reference points on a price chart, and they can be applied across various timeframes. In technical analysis, trend lines are a fundamental tool that traders and analysts use to identify and anticipate the general pattern of price movement in a market. You can draw a trendline for an uptrend by connecting the lows on a price chart.

Trendline trading strategies are one of the most simple and powerful trading signals in the market. Using a graphical representation of price, and indeed other metrics including trading volumes, can help traders spot major signal posts in the market. This guide will walk you through everything you need to know about trendline trading, from the basics of drawing trendlines to using them to.

:max_bytes(150000):strip_icc()/figure-1.-eurusd-trendlines-56a22dc33df78cf77272e6c7.jpg)