Heartwarming Tips About What Are The 3 Touches On Trendline How To Name Axis Excel

When you draw a trend line:

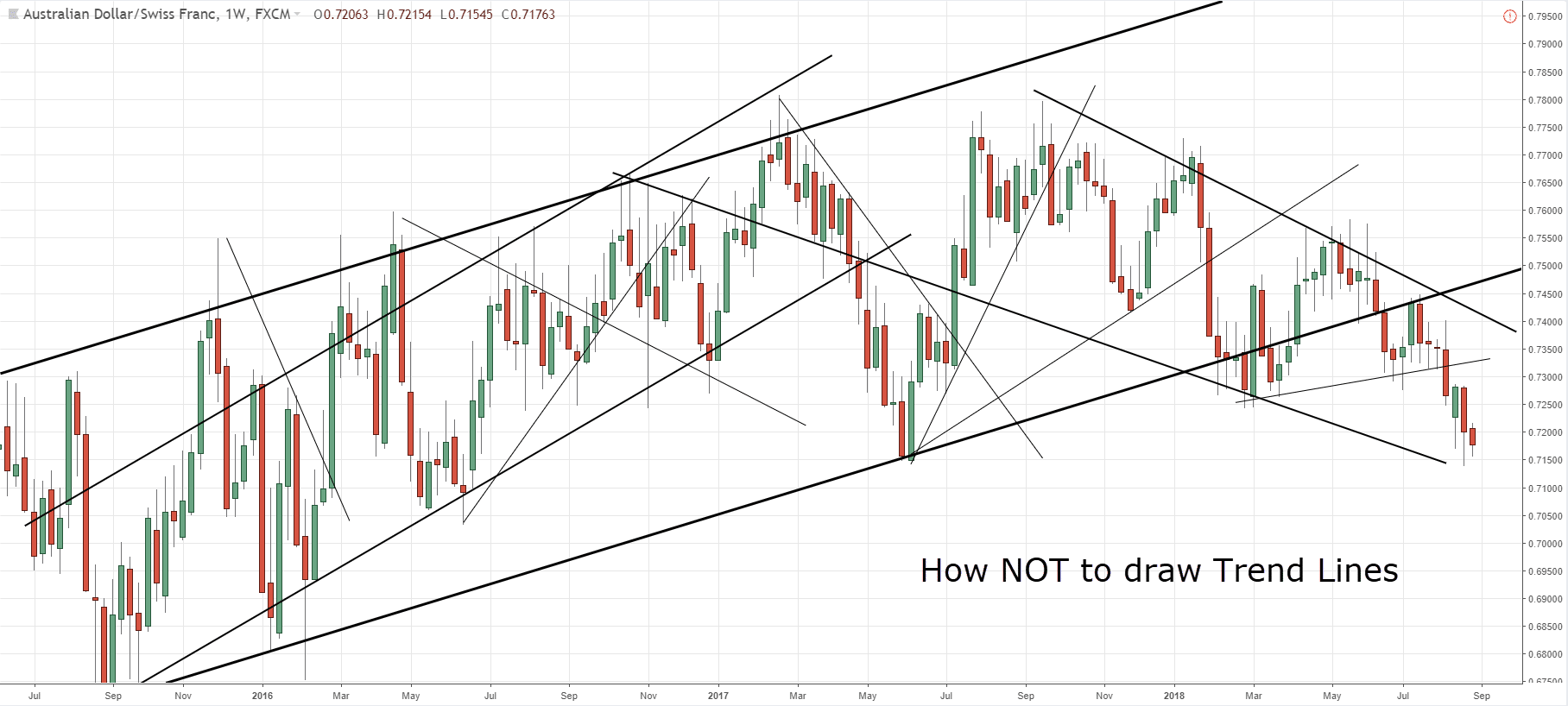

What are the 3 touches on trendline. The steeper the trend line you draw, the less reliable it is going to be and the more likely it will break. The third touch (also known as the third strike) trading strategy is another strategy that we are going to introduce to our traders. It slopes downwards, indicating that the price is likely to continue falling.

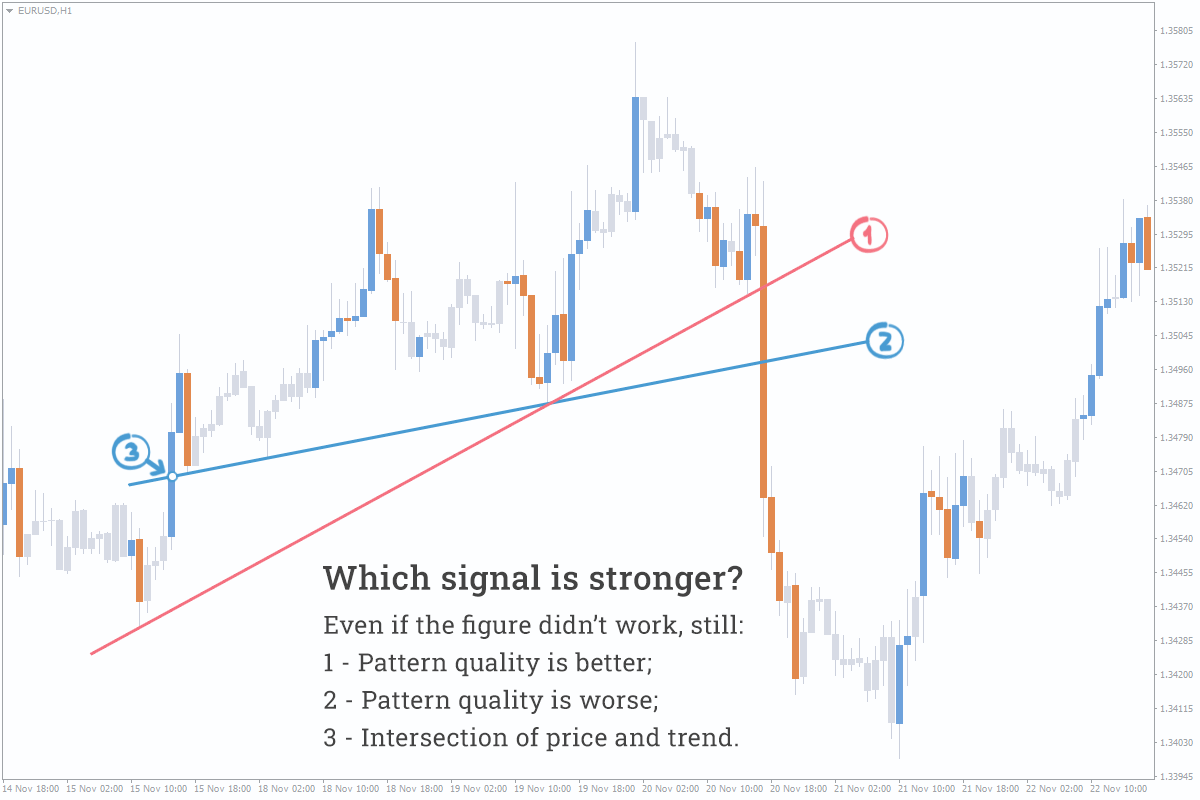

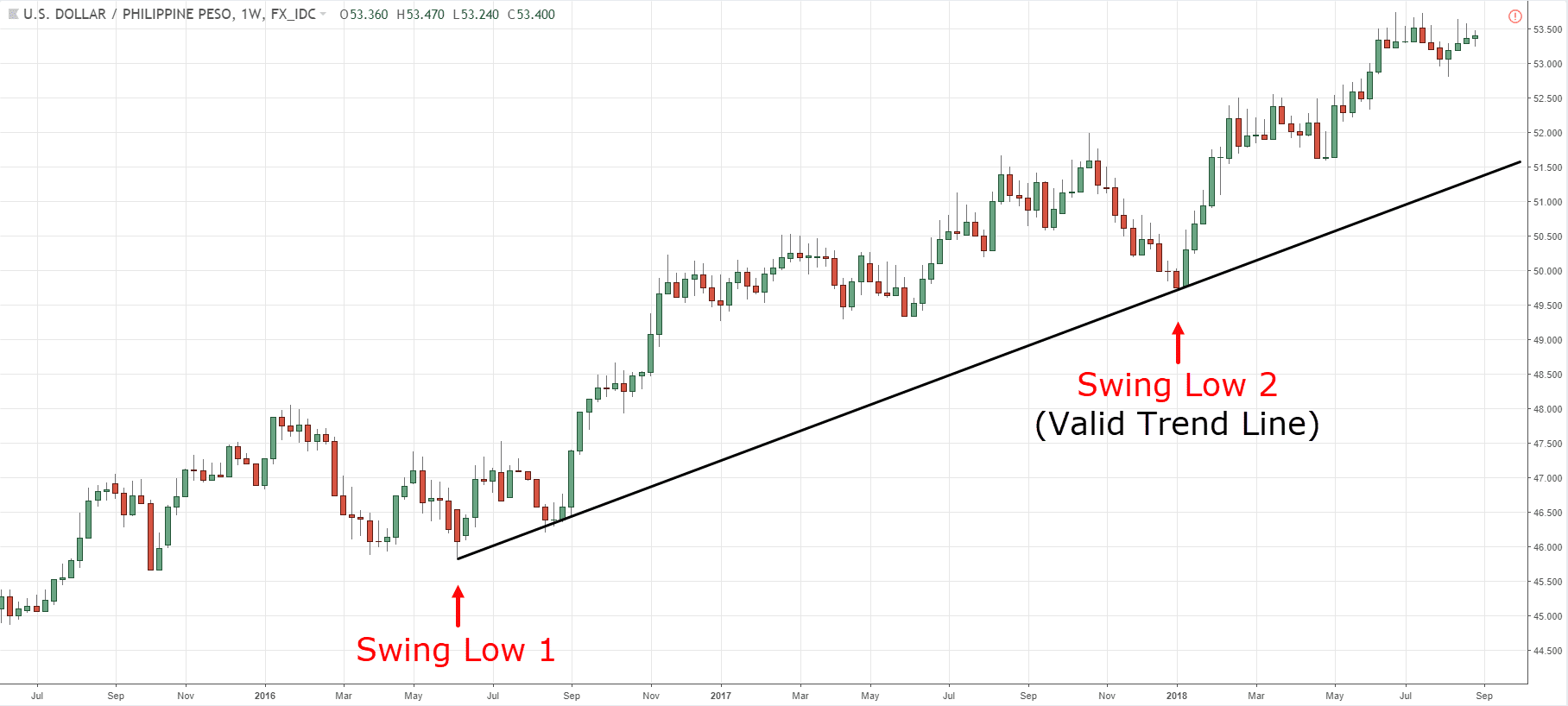

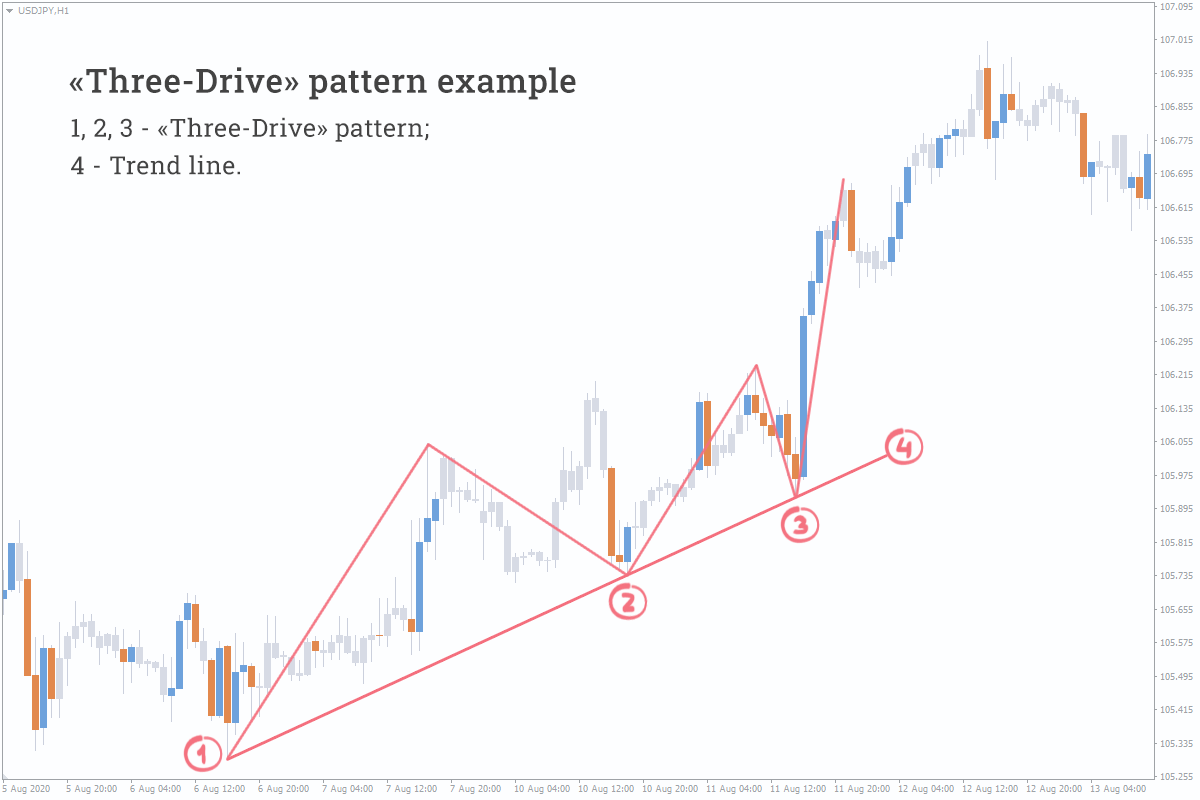

Locate 2 swing highs for a short or 2 swing lows for a long and then draw your trendline to connect the 2 points revealing the 3rd possible touch. There are three main types of trendlines: Why are trendlines important in trading?

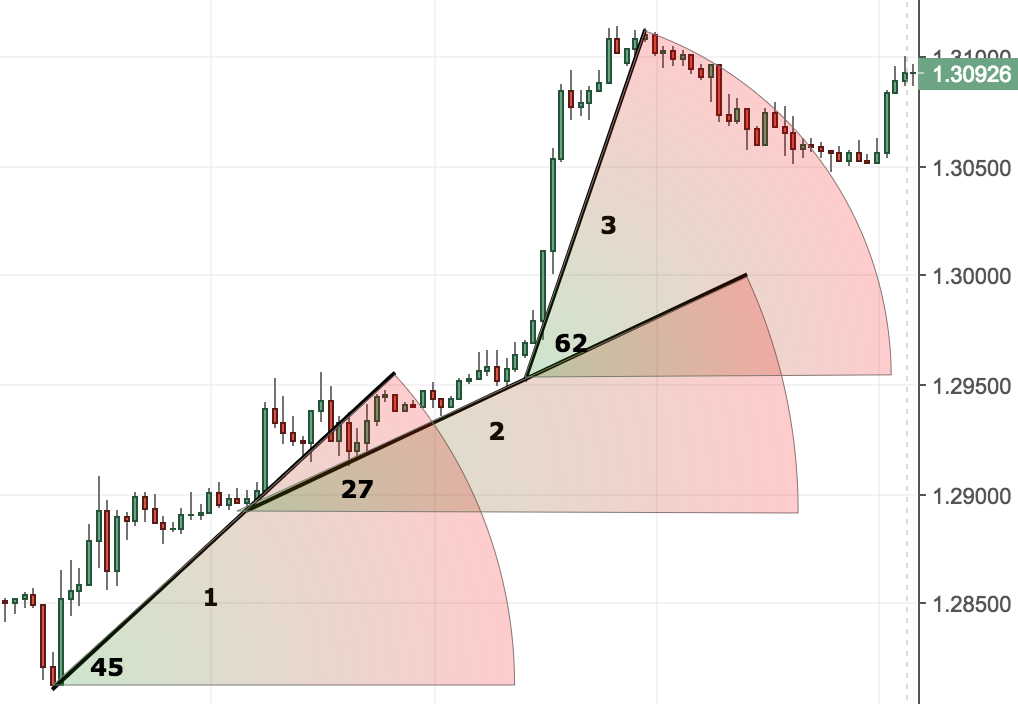

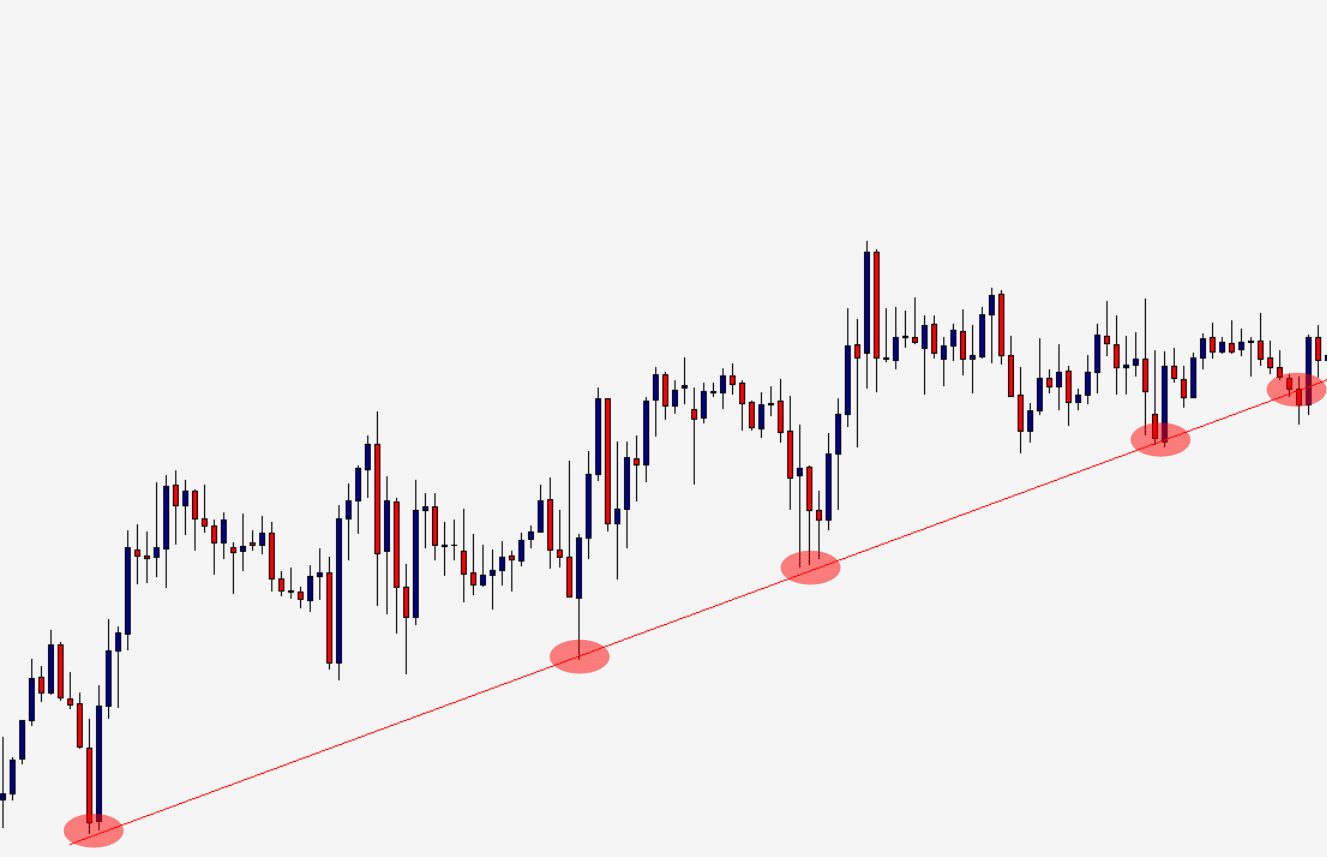

What are trendlines and how do they work? Although a trendline can also be drawn with only two touches of the price, these trendlines shouldn’t be considered as relevant for trading. 1) focus on the major swing points 2) connect the major swing points 3) adjust the trend line and get as many touches as possible;

The three types of trendlines. Here are some important things to remember using trend lines in forex trading: One simple rule for drawing trend lines.

Market moves that involve three touches of a trendline can soon break down. What is the utility of trendlines? Look for at least three touches on the trendline.

We introduce three powerful trendline strategies with various trade examples and chart analyses that will help you master trendlines. Nevertheless, experience shows that you should place greater trust in a trend line with three or more price touches. A trendline is a line drawn over pivot highs or under pivot lows to show the prevailing direction of price.

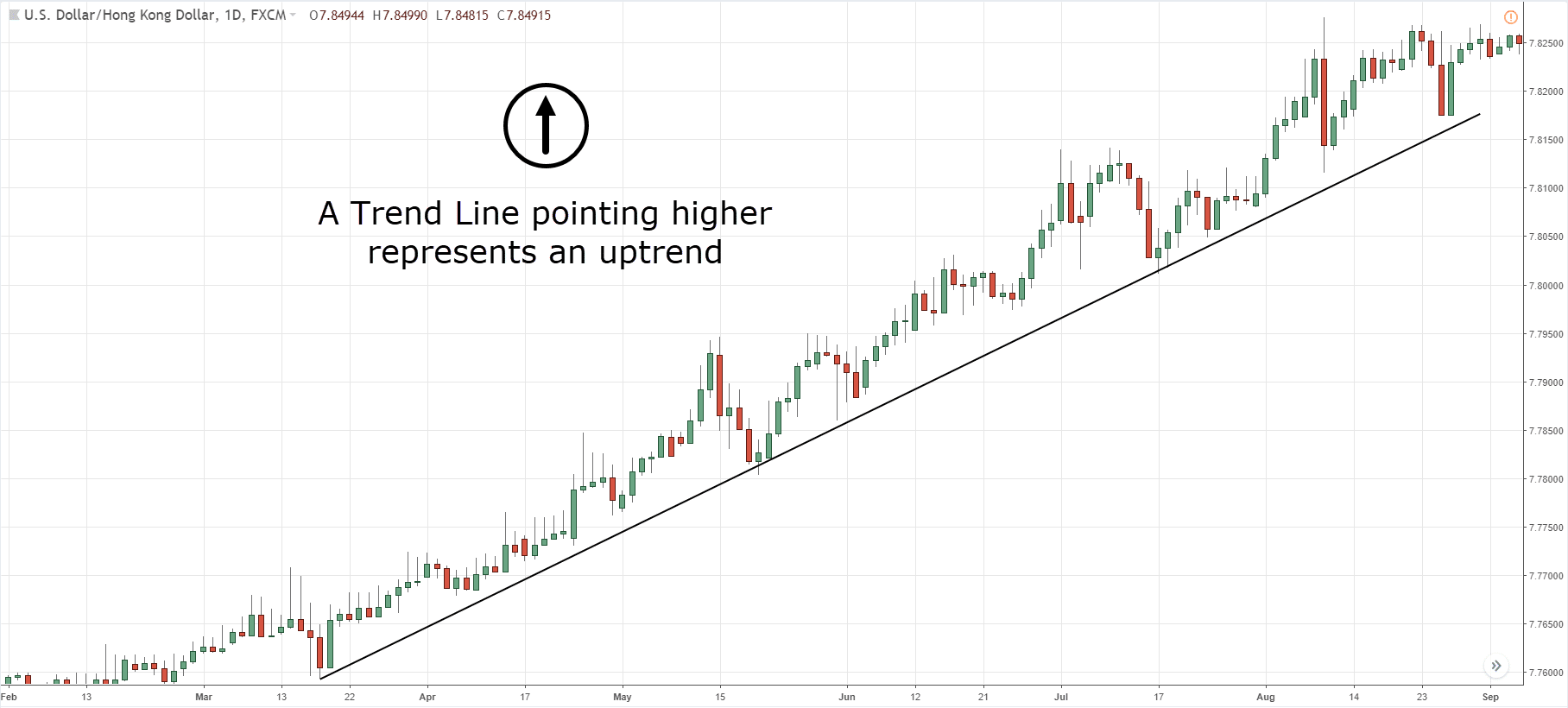

The steepness of a trend line gives you clues about the market condition so you can adjust your trading strategy accordingly All three can help determine if there’s a trading opportunity. Trend lines can be classified into three types:

A trend line is a straight line drawn on a stock chart connecting a series of points to indicate the prevailing price trends of a financial instrument. Multiple timeframes must also be considered. It provides support and resistance levels for successfully placing market entry or exit orders.

There are three main types of trendlines: However, for a trend line to be valid, at least three highs or lows should be used. There are three main types of trend lines:

How to use trendlines easily and quickly. An upward trendline acts as a support level, where traders expect the price to bounce back up when it touches the line. A trendline is a price line that is made by connecting the market price lows in an uptrend and market price highs in a downtrend.

![Gert van Lagen on Twitter "BTC [1W] update on Running Flat(RF](https://pbs.twimg.com/media/FQ8fvsZX0AAbDbW?format=jpg&name=large)